The Middle East and North Africa (Mena) region has undergone an enormous change over the past two decades, with unprecedented growth in economies and construction markets as countries in the region leveraged booming oil prices to invest in infrastructure and transform their cities into modern metropolises, according to an industry expert.

But over-reliance on oil revenues has caused government spending (and consequently growth) to fall as the oil price dropped, leaving the countries of the region seeking to reprioritize spending towards diversifying their economies and funding social investment, said Mace, an international consultancy and construction company.

Despite a rebound in GCC contract awards in H1 2017 of 14 per cent from a four-year low in 2016, results are still down 20 per cent from the same time last year, showing a challenging market, stated Mace's Mena cost consultancy business in its H2 tender cost report.

This competitive pricing environment has led to relatively stable tender price inflation across the region, ranging from 0.4 per cent in Kuwait to 2.5 per cent in Saudi Arabia, it said.

Event-driven projects and relatively diversified economies have proven a saving grace against this difficult backdrop, as has continued government investment in infrastructure and energy projects across the region, it added.

"Continuing the trend from 2016, the first half of 2017 has been competitive for the Mena construction market due to the low oil prices resulting in restricted government spending across the region," remarked Fergus Rossiter, the director of Mace Cost Consultancy (Mena).

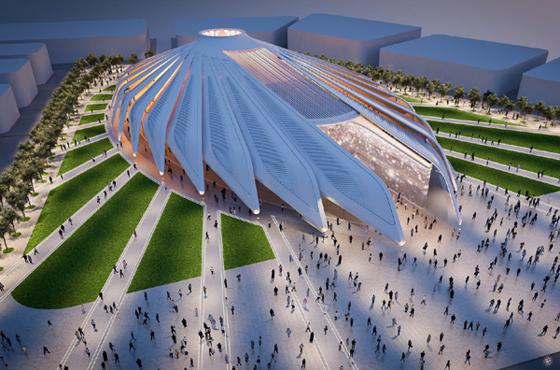

"However, as the work for upcoming major events starts to ramp up, notably Expo 2020 in the UAE and the Fifa Football World Cup in Qatar, we are starting to see an increase in tender prices, which is further fueled by recent increases in material prices, such as reinforcement steel," he noted. "We are yet to see the full impact of the current blockade has on the construction industry in Qatar, particularly as it relies heavily upon a large quantity of materials being imported from Saudi Arabia and the UAE,” he added.

Across the region tender prices have remained relatively stable, however there are considerable variations to be observed within the markets: some regions are reporting a softening in prices, while others experience some capacity constraints which are pushing them up.

Overall, the pricing environment remains very competitive with tender price inflation ranging from only 0.4 per cent to 2.5 per cent for 2017; client organizations are likely to continue to push to get the best possible prices, said Mace in its report.

Lower global commodity prices and increased competition for fewer privately and government financed projects is filtering through to increasingly competitive pricing in many markets, and despite there being plenty of work to fill order books, contractor and consultant prospects are vulnerable to tender periods taking longer to conclude, if at all, especially given recent government spending cutbacks due to the low oil price, it stated.

Contractors on key infrastructure or event-driven projects are less likely to be impacted by this, given the critical nature of these projects to the region’s ongoing economic diversification, however for the mainstream construction market, the competitive environment along with few capacity constraints in labor or materials and low commodity prices are all adding up to clients pressing for lower costs, it added.

According to Mace, factors such as the introduction of VAT across the region from 2018, as well as other taxes which may be levied as governments seek to consolidate their finances, are likely to put upward pressure on tender prices as contractors factor in these additional costs.

This effect will be particularly strongly felt in Saudi Arabia, with the highest tender price inflation at 2.5 per cent reflecting rising costs from newly imposed taxes and removal of subsidies for water and electricity, amongst others, as the Kingdom seeks to consolidate its finances.

Qatar is also expected to see some inflation in tender prices to reflect the greater materials cost risk, as new tenders force contractors to contractually bear the brunt of the costs of the blockade on the country, said the report.

Egypt is not considered in the Meed tender price index, but can be expected to see significant tender price inflation this year of at least 5 per cent, due to both the relatively hot construction market and the massive currency depreciation over the past year.

However some countries are faring better than others, with the UAE and Qatar boosted by their event-driven projects and relatively diversified economies, whilst Saudi Arabia and Oman struggle with reduced oil revenues, said the report by Mace.

Saudi Arabia and the UAE remain the biggest markets for construction projects, with the emirates looking likely to overtake the kingdom as the biggest next year, as their construction industry outperforms, stated the industry expert.

When considered with the completion dates edging closer for key event-driven projects such as the World Cup in Qatar, or the Expo 2020 in Dubai, strong demand-driven factors will counteract some of the damage from reduced government spending to the industry.

Locations less impacted by low oil prices are expected to outperform, with Dubai and Bahrain looking to beat Abu Dhabi or Kuwait. In addition, significant investment in port, road, railway and airport infrastructure across the region continues, with for example $37 billion worth of road projects being pursued across the GCC, it added.

TradeArabia