Multiple billion-dollar deals signed recently between Egypt and Saudi Arabia are part of a push by the latter to invest in long-term developmental projects in the North African country.

In early April Egypt and Saudi Arabia inked a deal to establish a SR60bn ($16bn) investment fund, part of a broader series of agreements between the two countries.

The memoranda of understanding (MoUs) – which include deals in agriculture, industry and infrastructure – were signed at Cairo’s presidential palace by Egyptian President Abdel Fattah El Sisi and Saudi Arabia’s King Salman bin Abdulaziz Al Saud.

Saudi’s shifting role

Since 2011 Saudi Arabia has played an important role in boosting Egypt’s economy and bolstering the country’s foreign exchange reserves.

The Kingdom extended $5bn in aid and loans as part of a $12bn package offered by Gulf allies after Egypt’s change of government in 2013. Saudi Arabia’s contribution included $2bn to boost foreign currency reserves, $2bn in energy products and $1bn in cash, Saudi officials said at the time.

The country now seems keen to move beyond valuable but short-term aid and toward development projects that will generate long-term value for both countries.

The investment fund, for example, will be shared equally between the Saudi Public Investment Fund (PIF), a sovereign wealth fund, and the Egyptian government, according to Egyptian state media.

The initiative is one of several that Saudi Arabia has launched in recent weeks with neighboring countries, including a joint investment commission with Jordan.

PIF is in the process of being expanded from its current $100bn holding to a targeted $2trn, international media reported in April. As part of this drive, PIF will significantly increase the share of foreign investment from 5% of its portfolio to 50% by 2020, according to Yasir Alrunmayyan, secretary-general of the fund.

Mutual benefits

In addition to the investment fund, further agreements signed by the two countries build on previous projects to expand the Suez Canal and promote Saudi private investment in Egyptian development projects.

The agreements will allow the Kingdom to diversify its investment portfolio and support the growth of Saudi investors and companies abroad, part of an overall strategy of economic diversification.

The series of deals includes a MoU between the Egyptian government and PIF to set up an economic free zone in Sinai as well as the development of a 2.25-GW electricity generation plant.

Saudi Arabia’s private sector is also showing increasing interest in opportunities in the Egyptian market, with the agreements expected to ease investment conditions.

According to chairman of the Saudi-Egyptian Council Abdulrahman Al Zamil, Saudi businesses were investing $4bn in infrastructure, energy and agriculture projects in Egypt, with substantial sums already committed.

Energy is a key area for Saudi private investment, with one Saudi company – ACWA Power – planning up to $12bn in investment in the Egyptian energy sector over the next five years.

“Egypt's power sector is able to [attract] new investments worth $30 billion in the next five years, backed by…legislative reforms and investment incentives provided by the country's government,” Hassan Amin, country manager at ACWA Power, told industry media.

Egypt has also allocated 202,000 ha of arable land to Saudi investors to encourage agricultural investment, according to Abdul Rahman bin Abdul Mohsen al Fadhli, Saudi Arabia’s minister of agriculture.

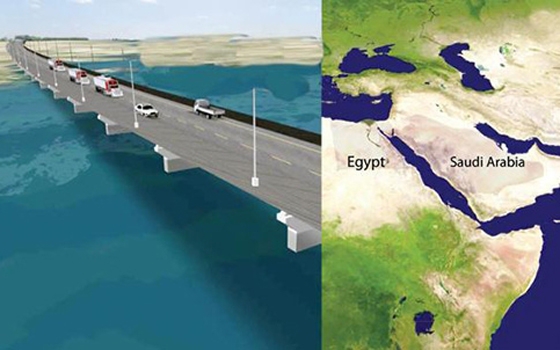

In addition, the agreement includes plans to connect the two countries via a bridge over the Red Sea. While no further information on the project has been released, previous estimates suggest the bridge could cost between $3bn and $4bn, international media reported.

Industrial ambitions

Saudi investors were also at the forefront of a recent agreement to develop a 6-sq-km industrial city near the Suez Canal.

The ASEC-Capital alliance, which includes prominent Saudi companies like Al Hokair Group and Al Muhaidib Contracting Company, along with firms from the UAE, Egypt and Lebanon, are planning $3.3bn worth of investment, Ahmed Darwish, head of the Suez Canal Economic Zone Authority, told media earlier this month.

The project includes an integrated business city, some 120 factories and a logistics zone.

This should allow Egypt to capitalize on its recent $8bn expansion of the canal. Completed in August after 12 months of construction, the “New Suez Canal” includes 35 km of new channels constructed in the desert, as well as a 37-km stretch where the existing canal was enlarged to accommodate larger ships.

According to official estimates, revenue from the canal is forecast to more than double in under a decade, from $5.3bn in 2015 to $13.2bn by 2023.

However, weaker global trade figures – as demonstrated by the Baltic Dry Index, which reached an all-time low in February – have underscored the importance of deriving alternate sources of revenue from the canal. Saudi investment in the nearby industrial city should go some way toward achieving this.

Oxford Business Group

4 May