The retail market in Qatar is undergoing a significant change, with a number of shopping malls due to open, according to the global real estate company DTZ

Qatar’s retail market dynamics promises to change considerably with the expected addition of more than 1mn sq m of space in some new shopping malls across the country, a new study has shown.

According to the global real estate company DTZ, the new retail space will be added to the local market this year and in 2016.

In a report, DTZ Research said the retail market in Qatar was currently undergoing a significant change, with a number of shopping malls due to open, bringing the much needed new supply.

“The retail sector in Qatar is driven by the high levels of disposable income. In 2013 the World Bank estimated that the per capita GDP (in Qatar) reached $136,727, representing the highest level of disposable income per capita in the world.

“The strong spending power within Qatar has seen significant increase in demand for retail accommodation from both local and international retailers with current occupancy levels in the main shopping malls at unprecedented levels,” DTZ said.

The retail market in Qatar is generally divided between organized retail malls, high street showrooms and souq retail.

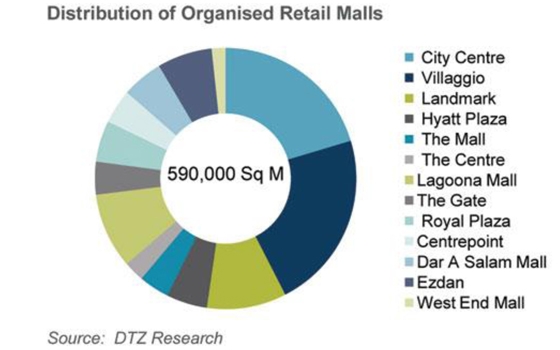

The organized retail market is currently dominated by the Villaggio and City Center malls, which between them account for 42% of the current supply. Overall supply currently stands at approximately 590,000sq m across 13 shopping centers.

“Retail rates have remained relatively stable in recent years,” DTZ said.

In the prime retail malls rents vary between unit sizes and their location within the malls. At the primary malls, rents range from QR220 to QR250/sq m a month for the medium size units.

Anchor stores have typically secured accommodation for between QR40 and QR80/sq m a month.

Elsewhere, the showroom retail market has seen the addition of Barwa Commercial Avenue, providing the much needed “good quality” accommodation. This development has added approximately 250,000sq m of new showroom accommodation, which represents approximately 25% of the total stock.

DTZ said it understands that more than 70% of the retail units have been reserved by various retailers.

Medina Central on The Pearl – Qatar has also increased the amount of retail space available in Doha. The development comprises approximately 65,000sq m of commercial space.

“We understand that lettings have been agreed on the majority of the retail units, which are due to open their doors in 2015,” DTZ said.

125 hotels under construction

Some 125 hotel establishments are under construction in Qatar, which, on completion, will increase the level of stock to approximately 35,000 room keys, according to real estate company DTZ. There was a significant increase in tourist numbers recorded by the Qatar Tourism Authority with hotel occupancy rates increasing from 65% in 2013 to 73% in 2014. The Qatar National Tourism Sector Strategy Plan: 2030 (QNTSSP 2030), published in February last year, outlined public and private investment of $45bn on tourism projects with a view to increasing tourist numbers from 1.1mn in 2013 to 7mn by 2030.

Gulf Times

16 February