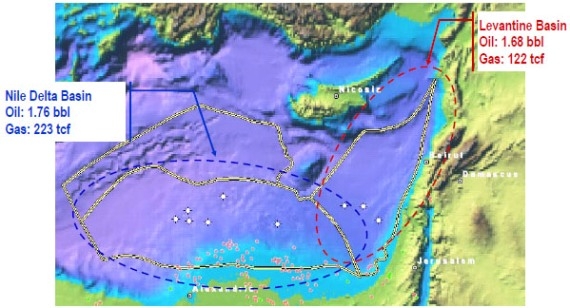

The US geological survey assessed that the Levant Basin Province, including parts of Israel, Lebanon, Syria, and Cyprus, could embrace as much as 122 trillion cubic feet of gas and 1.7 billion barrels of recoverable oil, the equivalent of 243 million tons.

Lebanon’s share of around 60 million tons, will cover local consumption for over 12 years

Lebanon imports around 4.9 million tons of petroleum oils and gases annually to satisfy local demand. Hence, if the quantity of oil discovered is to be equally shared among the cited countries, then Lebanon’s share of around 60 million tons, will cover local consumption for over 12 years, in addition to the discovered quantity of gas. While this holds great prospects, it poses significant political risks, especially for Lebanon.

The two gas fields of the northern Israel coast, Tamar and Leviathan, alone contain around 24.4 trillion cubic feet, part of which extends into Lebanon’s territorial waters. The maritime demarcation line between both countries is unclear at the moment, given the fact that both countries are at war. Hence, the discovery of offshore petroleum resources contributes only to rising territorial disputes between Lebanon and Israel, and preventing Lebanon from developing part of its oil and gas resources.

Until the demarcation sea line is settled, Lebanon can initiate exploring petroleum resources in areas that are not under dispute

Until the demarcation sea line is settled, Lebanon can initiate exploring petroleum resources in areas that are not under dispute. However, the process has been slow to move ahead. In fact, while Israel has been speeding up gas developments, especially in light of disruptions to its natural gas supplies, which resulted from war attacks on Egyptian pipelines over the past year, Lebanon is rolling at a slow pace. Israel has licensed fields to oil companies and initiated construction of sea base, yet Lebanon is still undergoing its first offshore licensing round.

The real amount of oil, and the type of oil materials lying deep beneath the surface of the sea, is determined only at drilling phase

While the country’s parliament approved the long-awaited draft bill on gas and oil exploration about a year ago, the inability to reach a consensus between parliament members regarding several decisions required to proceed, and the eruption of Arab spring that has deter some of the government’s attention towards ensuring political stability, made the progress on oil and gas’ project front slow. The exploration phase is almost complete. It consists of a two to three-dimensional survey conducted in Lebanese waters, to help analyze the outcomes before the drilling operation. The real amount of oil, and the type of oil materials lying deep beneath the surface of the sea, is determined only at drilling phase.

Once the government approves the issuance of the 13 principal implementation decrees, Lebanese Energy and Water Minister will launch the first round of licenses for foreign companies

The second stage consists of licenses and drilling. Once the government approves the issuance of the 13 principal implementation decrees, Lebanese Energy and Water Minister will make the preparations in coordination with those ministries concerned with oil, determined by a study undertaken by the Petroleum Authority, in order to launch the first round of licenses for foreign companies. After long delay, the Authority has been formed early November, with six members entitled to negotiate with international oil companies and issue licenses for the winning firms, namely, Nasser Hoteit, Walid Nasser, Wissam al-Zahabi, Assem Abu Ibrahim, Wissam Shbat, and Gaby Daaboul. A major challenge to be shortly faced by the Authority is to define the qualities and terms of the contracts to be signed with international drilling companies. These contracts are what set the type of benefits received by the state.

Lebanon could be transformed into an exporter of natural gas

Lebanon’s energy sector is set to undergo significant changes which are revealing slow, with the eruption of Arab Spring and the delay in the formation of a new budget. But such changes could transform the country into an exporter of natural gas, with the benefits set high, for a country with one of the highest debt rates in the world. Lebanon can access more reliable electricity supplies at competitive prices, and improve its public finances, trade balance and gross domestic product (GDP). Oil and gas discoveries would also pave way to investment in upstream and downstream industries, bringing economic diversification.

The Lebanon Brief – BLOM Research

5 December