The International Monetary Fund (IMF) issued its latest World Economic Outlook report in which it revised upward the MENA region’s 2012 real GDP growth from 4.2% to 5.3%. Conversely, the real growth figure for 2011 was revised downward from 3.5% to 3.3%.

The economic performance of oil exporters and oil importers has been increasingly divergent

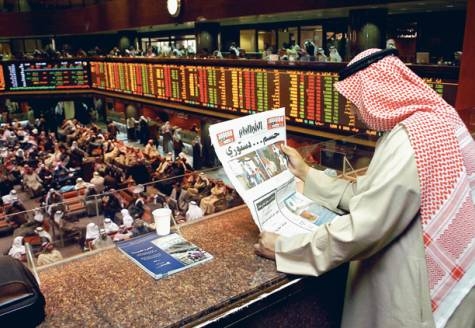

According to the Fund, the economic performance of oil exporters and that of oil importers has been increasingly divergent. With regards to the former, higher government spending in most of the member countries has supported robust growth. As to the latter, uncertainties from political and economic change after the Arab Spring, slowing growth in major trading partners, and, in some cases, internal conflicts, have led to a marked weakening in activity.

On the overall, growth in the MENA region was relatively subdued in 2011 but is projected to strengthen in 2012

On the overall, growth in the MENA region was relatively subdued in 2011 but is projected to strengthen in 2012 mainly boosted by the economic activity of oil exporters. As a matter of fact, real growth of this category is expected to accelerate from about 4% in 2011 to 6.5% in 2012, largely as a result of a strong rebound of activity in Libya since late 2011. In most other oil exporters, non-oil GDP growth is expected to remain robust in 2012, supported by ratcheted-up government spending, while oil sector growth is forecast to moderate after a strong increase in 2011. The boost from Libya will moderate in 2013, when real growth in the oil exporters of the region is projected to be 3.8%, as per the IMF.

Growth in oil importers has been about 1.3% during the 2011–2012 period, reflecting the effects of social unrest and political uncertainty, weak external demand, and high oil prices

In contrast, growth in oil importers has been about 1.3% during the 2011–2012 period, reflecting the effects of social unrest and political uncertainty, weak external demand, and high oil prices. Uncertainty has led to a pullback from the region, evidenced mainly in steep declines in tourism and FDI. At the same time, the contraction of activity in advanced Europe has been a drag on growth. Looking forward, uncertainty is expected to decrease as political transitions stabilize, and while external demand picks up, growth in oil importers is projected to recover to 3.3% in 2013.

Government expenditures have risen to such a degree that substantial declines in the price of oil could undermine fiscal positions

Risks to the near-term outlook for oil exporters revolve primarily around oil prices and global growth. Government expenditures have risen to such a degree that substantial declines in the price of oil could undermine fiscal positions. Despite significant accrued financial buffers, such declines could put at risk ongoing infrastructure investment and growth.

Oil importers face both external and internal risks. On the external side, they are vulnerable to trade spillovers if downside risks to growth in major economies materialize. Another concern is risks to internal and external balances from upside risks to food and fuel prices. Because of extensive food and fuel subsidies in most economies, the immediate concern with spikes in commodity prices is not the effect on inflation and disposable income, but rather the strain on budgets and foreign exchange reserves.

More broadly, the need to meet social demands in an environment of political uncertainty and weaker growth, has increased and resulted in higher budget deficits as well as declines in foreign exchange reserves.

Governments in the MENA region should prioritize economic and social stability through more inclusive medium-term growth

The Fund recommended that governments in the MENA region should prioritize economic and social stability through more inclusive medium-term growth. Achieving this goal will require institutional and regulatory reform to stimulate private sector activity and ensure greater and more equal access to economic opportunities and measures to address chronically high unemployment, particularly among the young.

Sources: International Monetary Fund, Bank Audi's Group Research Department

10 October