Citigroup expected the progress in Lebanon's efforts to exploit its potential offshore gas reserves to be slow but steady. It said that the current Cabinet has struggled to make progress in this area due to political infighting and ongoing instability, and despite a rare national consensus on the need to reduce the country's reliance on oil and gas imports. It noted that an oil and gas law was ratified in 2011, laying the legal groundwork for the hydrocarbon industry. It expected the board of the Petroleum Administration to be appointed in the coming weeks, which would enable Lebanon to hold its first round of bidding for exploration blocks. It said that the disputed maritime border with Israel will further complicate the industry's outlook.

But it pointed out that Lebanon can proceed with the development of its hydrocarbon industry within the agreed Exclusive Economic Zone (EEZ), until maritime border issues are settled by arbitration at the United Nations. It noted that the Ministry of Energy announced that seismic surveys of half of Lebanon's EEZ, excluding areas that are subject of territorial dispute between Lebanon and Israel, suggest the presence of up to 12 trillion cubic feet of gas.

In parallel, Citigroup considered that the production of gas will eventually lead Lebanon to energy independence, which would transform the country's fiscal and economic dynamics. It said that, over the past 5 years, Lebanon spent over $21bn on fuel imports and transferred $5.7bn to Electricité du Liban (EdL) to compensate for losses in electricity generation. It added that the Treasury transfers to EdL are equivalent to between 4% of GDP and 5% of GDP annually.

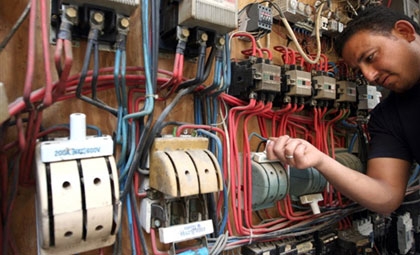

It noted that regular blackouts force private businesses to resort to costly diesel generators and act as a major deterrent to investment in the country. Further, it pointed out that bottlenecks in electricity supply also include lack of investment in generation capacity, inefficient production and distribution, and failures in the regulatory and tariff structure, among others. It noted that Lebanon's access to cheap locally-produced gas will significantly reduce production costs, but it will not resolve all of the sector's problems, which still require the implementation of energy reform policies that will be subject to political uncertainties.

Lebanon This Week – Byblos Research

2 October