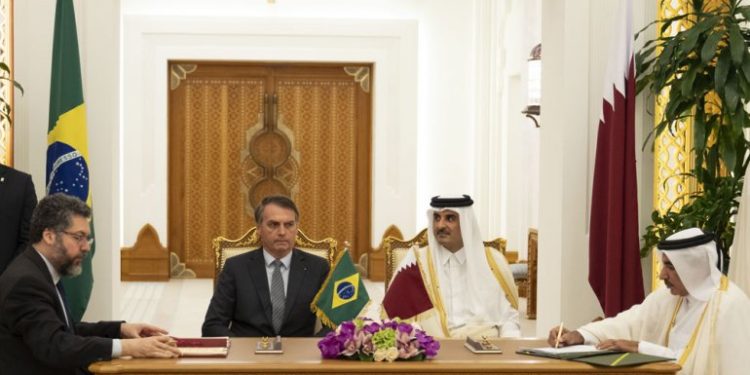

Qatari and Brazilian authorities yesterday held a high-profile meeting in the presence of the visiting President of Brazil, Jair Bolsonaro.

They discussed the huge investment opportunities arising out of the ongoing auctioning and divestment process of Brazil’s state assets, which include oil & gas fields worth over $250bn.

The roundtable meeting with the President was attended by representatives of leading Qatari agencies, companies, investors and business leaders. The Qatari side was led by Minister of Commerce and Industry, H E Ali bin Ahmed Al Kuwari, who also presented the investment opportunities in Qatar and highlighted the country’s robust macroeconomic fundamentals and growth prospects.

Present at the meeting were prominent Qatari businessmen, representatives from Qatar Investment Authority (QIA), Qatar Development Bank (QDB), Manateq, Qatar Free Zones Authority, Qatar Financial Centre and several other government and private entities and dignitaries.

Sheikh Faisal bin Qassim Al Thani, Chairman of Qatari Businessmen Association (QBA), and Sheikh Khalifa bin Jassim Al Thani, Chairman of Qatar Chamber, and several ministers and top officials of President Bolsonaro’s government explored the investment opportunities and ways of boosting cooperation.

“Brazil and Qatar are economies that have a lot to offer to each other. Our respect for Qatar is very high. Both the countries enjoy strong bilateral relationships in the field of trade, investment and defense cooperation but we want to further strengthen this. We want to boost the level of trust and restore Brazil’s credibility back. I am also trying to fulfill the promises that I made before taking office,” said President Bolsonaro in his address at the meeting. The President added: “We at Brazil have a sea of opportunities for investments in several promising sectors of the economy, which is now on the right path. We already have signed agreements with Qatar with regard to avoiding double-taxation and investment protection and other areas, but we want to give greater protection for investments.”

The Peninsula

29/10/2019