Driven by a steady influx of tourists from three top source markets, including India, Russia, and Oman, the UAE’s hospitality sector recorded a remarkable buoyancy in the first quarter of 2023 to provide a major fillip to the emirate’s real estate sector.

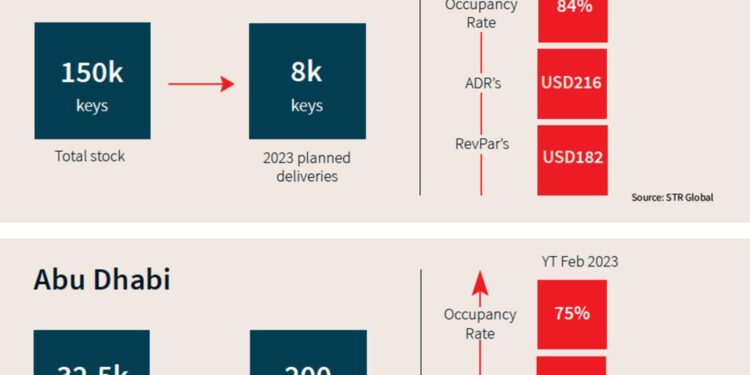

This year, Dubai’s hotel stock climbed to 150,000 keys with the delivery of around 2,000 keys. Propelled by increased demand, around 8,000 keys are expected to be delivered in the year. In comparison, Abu Dhabi’s hotel supply completions were limited, with around 200 keys added to the existing inventory, bringing the total stock to 32,500 keys. The capital’s future supply pipeline for the year remains modest at around 200 keys, according to the latest JLL UAE Real Estate Market Overview Report.

In the first two months of 2023, Dubai welcomed around 3.1 million tourists, representing a 42 per cent increase as compared to the same period last year, reflecting the exceptional resilience of the travel and hospitality sector, said the report.

While total retail stocks in Dubai and Abu Dhabi rose to 4.7 million sq. m. and 3.11 million sq. m. respectively, in the first quarter, off-plan transactions dominated the residential segment, outperforming existing properties in terms of value and volume in both the emirates, JLL said. Average Grade A rents in Dubai’s CBD rose by 16 per cent Y-o-Y followed by the capital recording a 9.0 per cent Y-o-Y increase in city-wide average Grade A rents.

The rise in inbound tourism also benefited the lower and mid-tier hospitality segments, which saw gains between 7-8 basis points (bps) in occupancy and RevPAR (revenue per available room) of 15 per cent for the first two months of the year.

“While all sectors continued to build on the performance of 2022, the year’s well-planned calendar of events coupled with the continuous increase in tourist numbers, have firmly placed the hospitality sector on a growth track, reaffirming its position as one of the strongest pillars supporting the UAE’s economic acceleration. However, macroeconomic volatilities continue to influence global travel trends, making it critical for operators to employ effective revenue management strategies to boost topline revenues, particularly those in the luxury segment,” said Faraz Ahmed, associate, Research at JLL Mena.

While the retail sector in Dubai remained stable with prospects of a steady pipeline ahead, well-located primary malls outperformed the overall market in Q1 2023, with average rents increasing by 1.0 per cent year-on-year. The city-wide average rents for primary and secondary malls decreased by 1.0 per cent year-on-year.

Residential supplies in Dubai rose by 9,800 units in the first quarter, raising the total stock to 690,000 units with an additional 32,000 units scheduled to be delivered in the year ahead. In the capital, around 1,800 units were added, bringing the total residential stock to 281,000 units. In terms of upcoming supply, Abu Dhabi has an additional 4,000 units in the pipeline for 2023.

Off-plan residential sales in Dubai also recorded a strong recovery in Q3 2022 in Dubai, propelled by new launches late last year.

“The trend has continued for the third consecutive quarter, with off-plan transactions outperforming existing properties in terms of value and volume, accounting for 56 per cent of total value and 59 per cent of total volume. This strongly indicates that both developer and investor confidence has returned to the off-plan market,” the JLL report said.

Within the retail sector, around 34,000 sq. m. of space was added in Dubai in the form of community retail developments, raising the total stock to around 4.7 million sq. m. in the first quarter. Over the same period, Abu Dhabi saw the delivery of a super-regional and community retail development totaling 212,000 sq. m. of retail gross leasable area, which subsequently pushed the capital’s total stock to 3.11 million sq. m. In the forthcoming months, around 213,000 sq. m. of retail space is scheduled to be delivered in both emirates combined, of which, approximately 194,000 sq. m. is projected for Dubai and 19,000 sq. m. for the capital.