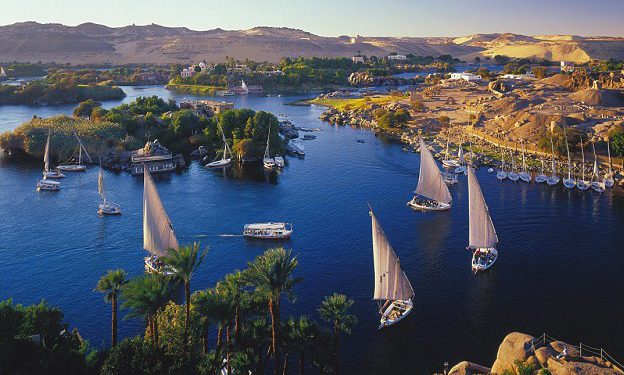

The governor of the Central Bank of Egypt (CBE) announced the launching of an EGP 5 billion ($261 million) fund to help investors develop and upgrade tourist facilities including hotels, resorts and Nile boats nationwide, state news agency MENA reported.

The financing will be in the form of loans with a 10 percent interest rate, CBE governor Tarek Amer said at a meeting with the South Sinai Investors Association, according to MENA.

Amer said that the fund is to enable the owners of tourist facilities to undertake renovations and maintenance in the face of the slump in the tourism sector.

To be eligible for the loans, the applicant must own at least 30 percent of the property.

The CBE governor added that the new fund would provide 75 percent of the needed funding for the developing of facilities, with the investor to be responsible for the remaining 25 percent.

Head of the South Sinai Investors Association Hesham Ali said that a number of banks will take part in establishing the fund, most notably the National Bank of Egypt, Banque Misr and Banque du Caire.

Tourism in Egypt has been struggling since Russia and a number of European countries suspended in late 2015 passenger flights to the popular Egyptian resort of Sharm El-Sheikh in South Sinai. The flight bans came after the downing of a Russian passenger jet in Sinai in October 2015.

All the countries that imposed flight bans, with the exception of Russia and the UK, resumed flights to the resort city by mid-2016.

Egypt's revenues from tourism dropped by 48.9 percent to $3.8 billion in 2015/16 from $7.4 billion in 2014/15, the Central Bank of Egypt announced in August.

The CBE has extended to 2017 its initiative to support the tourism sector, which includes more flexible economic measures on payments.

The bank is currently considering delaying loan payment deadlines for the tourism sector to December 2018, Amer said, adding that the proposal will be presented to the bank's board.

Amer stressed the importance of staff training to provide the best services for tourists, adding that investors should use local products to avoid higher prices due to the increased cost of the dollar after the pound flotation.

In early November, Egypt's central bank decided to freely float the pound and raise key interest rates as part of a set of reforms aimed at alleviating a dollar shortage and stabilizing the country's flagging economy.

Egypt's economy has been struggling since the 2011 uprising, with a sharp drop in tourism and foreign investment, two main sources of hard currency for the import-dependent country.

Ahram Online

27 December