Kuwait’s economic growth is expected to recover on higher oil prices, which will enable an expansionary budget and higher project spending boosting the pace of GDP growth, according to QNB’s Kuwait Economic Insight 2018 report.

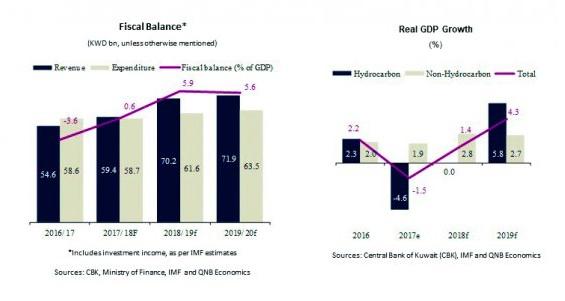

The report examined recent developments and the outlook for the Kuwait economy. “In 2018, we expect growth to recover to 1.4 percent as the non-hydrocarbon sector benefits from higher oil prices, stronger fiscal spending on the back of an expansionary budget and higher project spending. Hydrocarbon growth will remain flat due to the continuation of the Opec agreement”, noted the report. In 2019, growth should accelerate further to 4.3 percent as hydrocarbon production is boosted to pre-Opec levels. Non-hydrocarbon growth will likely slow slightly on a smaller fiscal expansion and softer oil prices.

Government capital expenditure and project spending will be focused on the completion of projects related to Kuwait’s medium-long term vision. These include expanding the country’s crude and refining capacity, major road infrastructure projects, as well as strategic projects relating to Kuwait’s logistics, healthcare, and housing sectors.

QNB expects oil prices to average 69/b in 2018 and the oil market to balance as increased supply from non-Opec producers is met with increased global demand. In 2019, QNB expect oil prices to dip to 66/b as global demand growth slows, the Opec agreement is lifted and further productivity gains are made by shale oil producers. The fiscal surplus should widen to 5.9 percent as revenue grows faster than spending, thanks to higher oil prices. The government’s announced 2018/19 budget sees higher spending on wages and subsidies as well as higher capital expenditure. In 2019, the surplus should narrow only slightly to 5.6 percent as higher capital spending more than offsets the increase in revenue to GDP. Non-hydrocarbon revenue should see a boost with the implementation of VAT.

In the banking sector, we expect deposit growth to improve on the back of a wider fiscal surplus while loan growth should benefit from higher project spending and the government’s expansionary capital expenditure plans. Kuwait’s positive operating environment and improved growth outlook should keep banks’ profitability and capital adequacy ratios at healthy levels.

The Peninsula

05/06/2018