Qatar, along with other GCC countries, appears most ready for fintech adoption in the Middle East and Africa (MEA), thanks to the preference of clients for digital banking, the ready availability of financial capital, and a push by regulators.

S&P Global Ratings said in its report on “Fintech’s prospects in the Middle East and Africa” yesterday that it believes that financial technology (fintech) in the Middle East and Africa (MEA) will continue to expand and therefore constitute a limited threat to the region’s well-established financial institutions in the foreseeable future. The creation of a fintech ecosystem is still a work in progress on most regional countries.

In a recent interview to Oxford Business Group (OBG), Qatar Central Bank Governor H E Sheikh Abdulla bin Saoud Al Thani said Qatari government is actively promoting the country as a regional center for fintech as new cost-effective technologies are becoming increasingly prominent worldwide.

Under the country’s Second Strategic Plan for Financial Regulation 2017-22, fintech has been recognized as a primary tool for achieving long-term development goals for the financial sectors is actively promoting the country, he said.

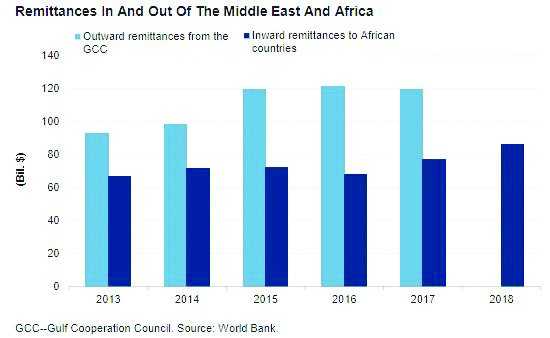

The S&P Global is of the view that money transfer, payment services, and compliance with regulations are the main sectors that are bound to be disrupted by fintech in the next few years. It also believes fintech offers other opportunities for the region’s banks, such as financial penetration in less developed African countries and use of blockchains for capital market issuances of conventional and Islamic securities. However, several pre-requisites are necessary for that to happen”.

S&P does not expect fintech alone to have a significant bearing on its ratings on Middle East and African banks in the next two years. Instead, it foresees more cooperation between fintech firms and banks and strong regulatory protection given the significant role of banks in financing regional economies.

Key indicators show that GCC countries appear to be the most ready for fintech adoption in MEA. The key driver is a demand-the preference by clients for digital banking. Moreover, these countries enjoy the ready availability of financial capital. Their banking systems are strongly capitalized.

S&P estimates the average risk-adjusted capital for rated banks was close to 12 percent at year-end 2018. In addition, they are typically net exporters of capital, and some GCC governments set aside funds to push forward the fintech agenda.

The fintech ecosystems in North Africa and Sub-Saharan Africa, however, appear less friendly than those in the GCC.

The global ratings agency believes that fintech could help the financial industry at least three ways-erase transaction speed and reach of financial services; security and traceability of transaction; and improved governance. GCC banks, for example, generate about one-quarter of their revenue from non-interest-dependent sources.

The Peninsula

12/06/2019